That means that instead of receiving monthly payments of say 300 for your 4. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments.

Child Tax Credit Payment Schedule Here S When To Expect Checks King5 Com

The portal is anticipated to let tax nonfilers submit a simplified digital kind to the IRS to secure their eligibility.

Child tax credit 2 irs portal. The IRS will open a second portal dedicated to people who dont typically file their income taxes. How to check if youre getting 300 monthly payments. Determine your filing status with the Interactive Tax Assistant.

Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

New online portal and IRS tools help families before July payment. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Is the web portal the best way to apply what other options do I have.

Posted Jun 23 2021. Two IRS Portals Are Being Created to Help You Get Your Child Tax Credit Money. 2 In the.

Claiming Dependents and Filing Status. File Form 8332 ReleaseRevocation of Release of Claim to Exemption for Child by Custodial Parent. CHILD TAX CREDIT.

That means that instead of receiving monthly payments of say 300 for your 4. A web tool now lets eligible low-income parents register for their first July 15 child tax credit check. These changes apply to tax year 2021 only.

TWO vital IRS portals will help parents get boosted child tax credit - and ensure they get the FULL amount of money theyre entitled to. You will claim the other half when you file your 2021 income tax return. Because these credits are paid in advance every dollar you receive will reduce the amount of Child Tax Credit you will claim on your 2021 tax return.

Irs child tax credit 2021 update portal. This child tax credit portal will allow this group to give the IRS their updated information. For the next six months eligible families we be sent a payment of up to 300 per.

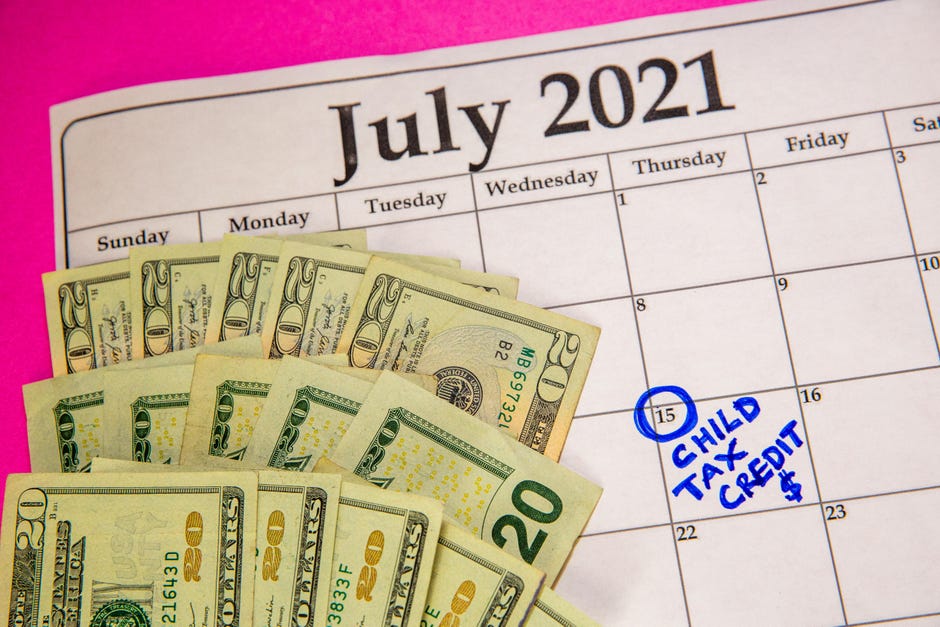

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant. IRS child tax credit.

The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. The tax credit will allow for up to 3600 per child for children under 6 years of age before the end of the year and 3000 for each child over. Child Tax Credit Update Portal.

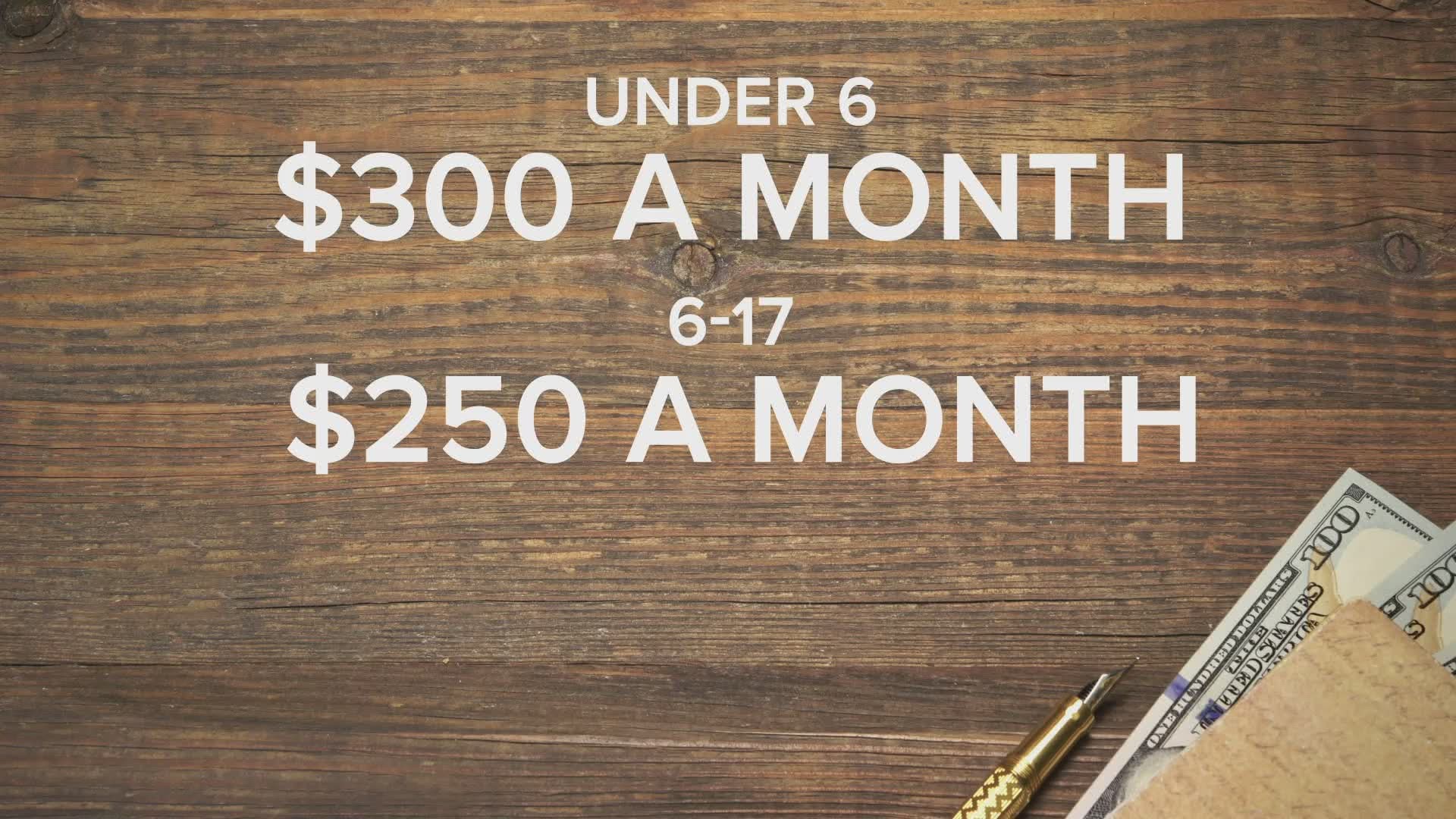

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. IRS opens Child Tax Credit portal. An expansion of the child tax credits as part of the American Rescue Plan stimulus relief bill is slated to begin July 15.

Child tax credit. Updated Jun 23 2021. Read our publication about the tax rules.

This little one tax credit score portal will permit this group to offer the IRS their up to date info together with the quantity and ages of their qualifying little one dependents. The next deadline to opt out is Aug. That means that instead of receiving monthly payments of say 300 for your 4.

President Joe Biden said that American families will automatically receive monthly payments of up to 300 per child from July 15 under a new tax break. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

If you filed a 2020 tax return or used the IRS. This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17.

FILE - This May.

Irs Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Southern Maryland Chronicle

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Child Tax Credit 2 Irs Portals Will Let You Decline Monthly Checks And Update Your Info

H R Block A Portion Of Your Child Tax Credit Payments Ctc Will Now Be Distributed Through Advance Payments That Means If You Want To Opt Out Of These You Ll Need To

Irs 2 New Online Tools Available To Help Manage Child Tax Credit King5 Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Com

The Irs S Child Tax Credit Portal Looks Like Crap And It S Not Really Usable For Low Income Americans Trying To Get 300 Monthly Federal Payments

Irs Child Tax Credit Portals Now Available Can Help You Get Your Payments This Year Cnet

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Two Important Irs Portals Will Help You Make Sure You Get The Full Amount Of Money You Re Entitled To

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Child Tax Credit 2 Irs Portals Will Let You Decline Monthly Checks And Update Your Info

Child Tax Credit 2 Irs Portals To Help You Get Your Cash Here Is What They Are For

Irs Child Tax Credit Payments Start July 15

Irs Child Tax Credit Portal For Non Filers Is Open For Business

Irs Website Has Tool To Update Direct Deposit Info For Child Tax Credit Cpa Practice Advisor