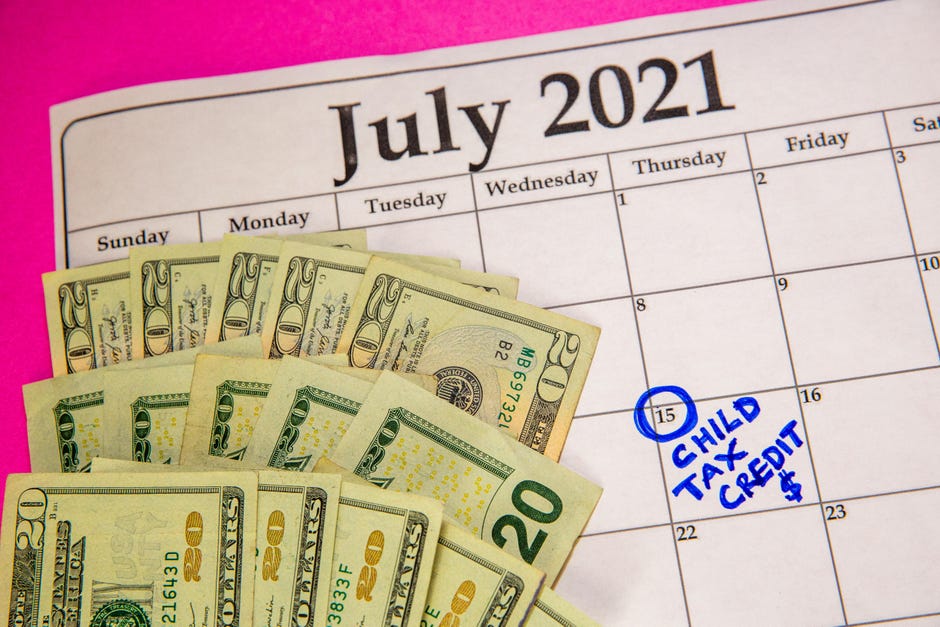

The payments will begin on July 15. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Child Tax Credit Dates Ages Qualifications Eligibility And Everything You Need To Know Marca

To create a new IDme account.

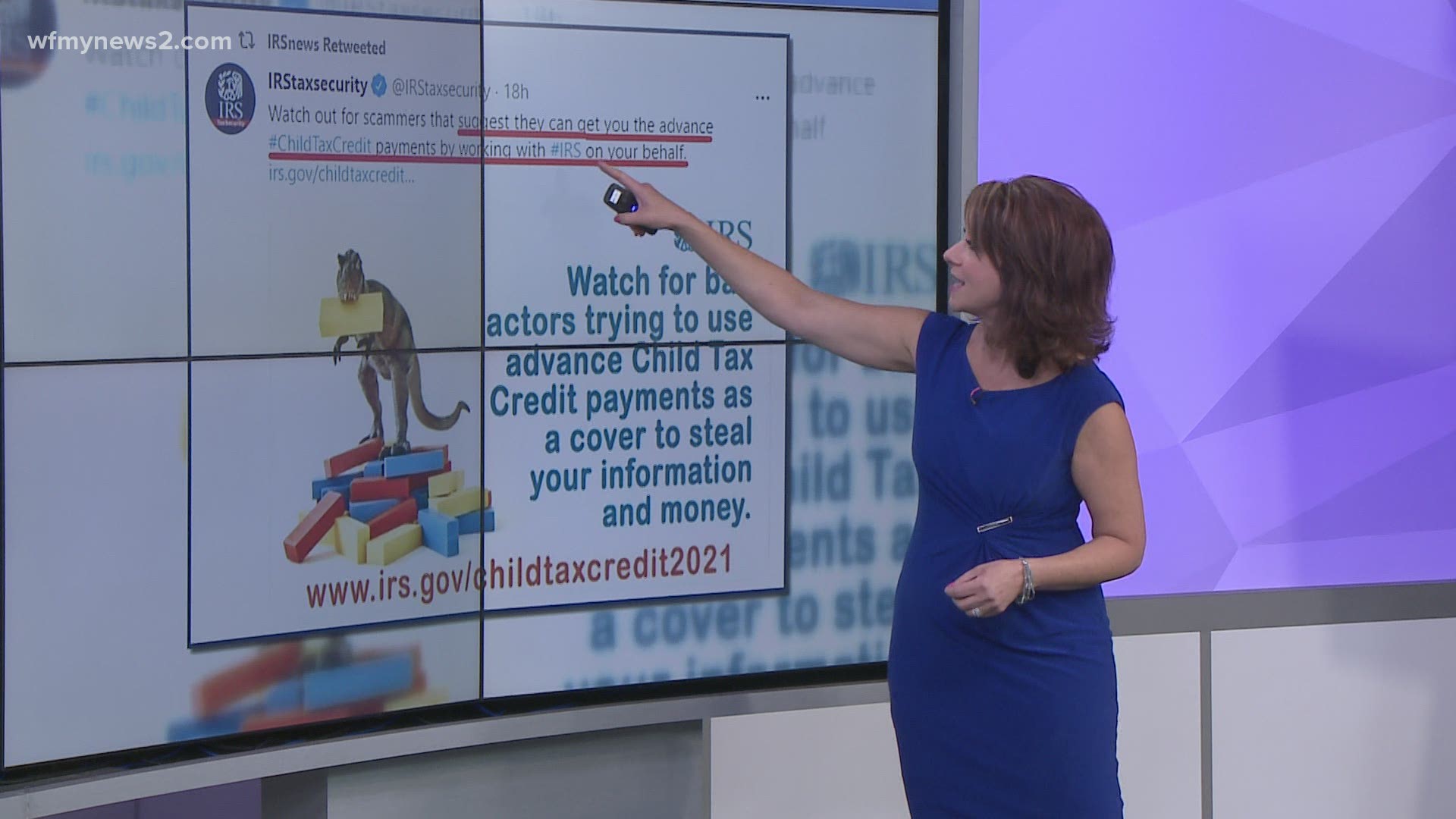

Child care tax credit update portal. The next deadline to unenroll is Aug. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Is the web portal the best way to apply what other options do I have.

Called the Child Tax Credit Update Portal the tool allows people to un-enroll from the tax credit before the first payment is made on July 15. Click Unenroll from Advance Payments. Due to processing times changes might not be reflected immediately on your next payment.

These changes apply to tax year 2021 only. The child and dependent care tax credit can be claimed for certain expenses related to childcare services. You can add or change your bank account information through the IRSs Child Tax Credit Update Portal.

The child tax credit is a major component of the plan to lift millions of children out of poverty. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. If you filed a 2020 tax return or used the.

Once it determines eligibility the tool will also indicate whether or not you are enrolled to receive the. Half the total credit amount will be paid in. Child Tax Credit Update Portal.

The IRS has identified over 36 million families that may qualify for monthly child tax credit payments of up to 300 per child. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Advance Child Tax Credit.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. An IDme account the IRSs new authorization system to access the CTC opt-out portal. A family of four making less than 150000 could see more than 14000 in pandemic relief this.

Another tool the Child Tax Credit Update Portal will initially enable anyone who has been determined to be eligible for advance payments to see that they are eligible and unenrollopt-out of the. Earned Income Tax Credit. More In Credits Deductions.

The next deadline to opt out is Aug. IRS child tax credit. According to a release issued this week the IRS said both an eligibility tool and a Child Tax Credit Update Portal would be launched in the next few weeks That second one the update portal.

The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. Unenrolling may be desirable if for instance taxpayers expect the amount of tax. 7 rows And the Child Tax Credit Update Portal lets you verify your eligibility and opt.

CHILD TAX CREDIT. It could be up to 8000 for one child and 16000 for two or more dependents and parents could be able to claim up to 50 per cent depending on their income. The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out.

You will claim the other half when you file your 2021 income tax return. Log onto the child tax credit update portal to confirm your eligibility for payments. Businesses and Self Employed.

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. An existing IRSgov account or.

Stimulus Plan 3 000 Child Tax Credit Payments Start In July

Bestow Life Insurance Login How To Sign In To Your Bestow Member Portal Insurance Diaries In 2021 Life And Health Insurance Life Insurance Companies Life Insurance

2021 Child Tax Credit Does Each Kid Qualify For The Full 3 600 We Ll Explain Cnet

Child Tax Credit 2021 When Payments Start How To Opt Out

Your Child Care Payments Could Get You Up To 16 000 In Credits Everything To Know Cnet

Child Tax Credits Irs Unveils Online Tool As It Prepares To Send Out July 15 Payments

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check Wavy Com

Five Facts About The New Advance Child Tax Credit

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Irs Child Tax Credit Payments Start July 15

Ask Your Accountant Child And Dependent Care Credit This Summer Painting Activities Creative Painting For Kids

How Do I Manage The Child Tax Credit Monthly Payment 9news Com

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Revised Child Tax Credit Everything You Need To Know Ramseysolutions Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Monthly Child Tax Credit May Arrive As States End 300 Unemployment Boost

Personel Tni Disiagakan Hadapi People Power Di Monas Hoax Militer Kekuatan Monumen

Child Tax Credit Here S How To Collect Your Monthly Payments Bankrate